Refinancing a home equity loan, or HELOC, allows many consolidators to improve their financial situation. Research suggests that many homeowners have found value in refinancing to get a better interest rate, lower their monthly payments, and have additional funds for excellent opportunities.

These days, out of the constantly changing interest rates and ever-increasing financial needs, refinancing allows people to tap into their home equity more wisely. Whether it is to pay off an existing credit card debt, lock in a low interest rate, or finance an important venture, refinancing certainly has many advantages.

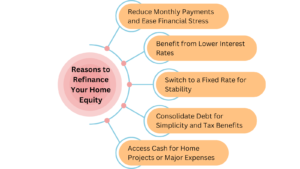

So, here are five prime reasons why it would be a good idea for people to consider refinancing their home equity loans in the current environment.

1. Lower Your Monthly Payments and Reduce Financial Stress

Refinancing can significantly ease the monthly financial strain by reducing payments and freeing up funds for savings or other needs. With home equity loan rates today at competitive lows, homeowners have an opportunity to lower costs and improve cash flow.

For instance, refinancing a $500,000 loan from a 4.20% to a 3.59% interest rate can reduce monthly payments from $2,445 to $2,270, resulting in potential lifetime savings of $63,000.

These reduced payments can create substantial financial flexibility:

- Create Emergency Funds: Lower monthly payments allow homeowners to set aside funds for unexpected expenses or emergencies.

- Channel to Other Financial Objectives: Payments that have reduced amounts allow that money to be used towards contributions towards retirement, education, and others.

- Reduce Monthly Cost of Living: For most people, having a mortgage payment often puts a strain on the monthly budget, and refinancing gives more flexibility in the amount to be paid for debts.

Understanding Payment Reduction Strategies

To maximize the benefits of lower payments, consider the following strategies:

- Extend Your Loan Term: If cash flow is your primary concern, extending the loan term while refinancing can lower your monthly payments even further.

- Refinance When Your Credit Score Has Improved: A higher credit score can qualify you for better interest rates, reducing your monthly costs.

- Combine Mortgages for Better Rates: Combining a first mortgage and second mortgage, or existing HELOC, under one lower-rate home equity mortgage can simplify your finances and lower payments.

2. Take Advantage of Lower Interest Rates

One of the most compelling reasons to refinance is the opportunity to lock in lower home equity loan rates, which can yield substantial savings over time. Homeowners who secure even a modest reduction in interest rate can experience significant financial benefits.

For example, refinancing from 4% to 3% on a $300,000 home equity loan could save approximately $60,000 in interest over 30 years.

Key Benefits of Lower Rates

The advantages of reducing your interest rate include:

- Lowering the Total Interest Paid: The interest amount paid by the borrower over the entire period of the loan also benefits from lowering the rate.

- Expanding Equity Growth: At times of lower interest rates, there is a larger portion of the payment that goes towards the principal, thus propelling the faster growth of the equity.

- Exploring Shorter Loan Terms: If your monthly budget allows, refinancing to a shorter loan term can reduce total interest even further without drastically increasing payments.

Optimizing Rate Benefits

To make the most of a favorable interest rate:

- Explore Different Providers: Shop for the lowest home equity loan interest rate from different providers.

- Analyze APR and Interest Rates: Ponder both the APR and the interest rate since each of these shows a true cost associated with the borrowing of funds.

- Determine the breakeven point for interest savings relative to closing costs: Establish when the interest savings will reach the point where closing costs can be ignored which makes the process of refinancing beneficial.

3. Switch from Adjustable-Rate to Fixed-Rate Loans for Stability

Property owners carrying an adjustable rate HELOC might be thinking that refinancing into a home equity loan on a fixed rate basis would be a good choice, particularly in times when interest rates are on the upside. Such Fixed rate loans ensure certainty and thus considering that loan the homeowners can manage and budget their finances accurately without any fear of a potential increase in rates.

In exactly the opposite to adjustable rates which are susceptible to movements in the marketplace, fixed rates are frozen in time for the duration of the loan meaning that the borrower will have a clear understanding of how much his repayments are going to be for the life of the loan.

Understanding Rate Conversion Benefits

Switching from an adjustable to a fixed rate can offer several advantages:

- Protection Against Rate Increases: Fixed rates eliminate the risk of rising payments, which can be particularly beneficial during inflationary periods.

- Budget Predictability: Fixed-rate loans ensure consistent monthly payments, simplifying financial planning.

- Long-Term Financial Security: With fixed payments, homeowners can better manage cash flow and mitigate the risk of “payment shock.”

Fixed vs. Adjustable-Rate Home Equity Loans

Understanding the differences between fixed and adjustable-rate home equity options can clarify the decision to switch:

| Feature | Fixed-Rate Home Equity Loan | Adjustable-Rate HELOC |

| Interest Rate | Constant | Changes with market |

| Monthly Payment | Predictable | Can vary significantly |

| Budget Planning | Easier to manage | Requires flexibility |

| Best For | Long-term financing needs | Short-term borrowing |

| Risk Level | Lower | Higher |

| Initial Rates | Usually higher | Often lower to start |

Transitioning to a fixed rate through refinancing offers a dependable way to secure a more stable financial future, especially for homeowners planning to stay in their homes long-term.

4. Consolidate Debt for Simplicity and Potential Tax Benefits

Utilizing home equity to eliminate high-interest debts can be a great strategy to streamline debts and manage interests better. Refinancing by taking a second mortgage can help combine many credit card debts or personal loans into one single home equity loan at a lesser rate in most cases.

Financial Advantages of Debt Consolidation

By consolidating debt into a home equity loan, homeowners gain:

- A Single Monthly Payment: Consolidation eliminates the hassle of juggling multiple payments and due dates.

- Lower Overall Interest Rates: Home equity loans typically have lower rates than credit cards, which can substantially decrease interest expenses.

- Potential Tax Deductions: Interest on home equity loans used for eligible expenses may be tax-deductible, adding further savings.

Strategic Debt Consolidation Approach

For optimal results when consolidating debt, consider:

- Prioritizing High-Interest Debt Elimination: Pay off the highest-interest debts first to maximize savings.

- Creating a Debt Inventory: List all debts to see where consolidation can reduce your total interest payments.

- Setting Up Automatic Payments: This ensures timely payments and improves credit over time.

5. Access Cash for Home Improvements or Major Life Expenses

The refinancing of a home equity loan or a HELOC enables homeowners to borrow a low-cost loan for completing perhaps important or worthwhile projects. This option is ideal for investments with high returns whether it be home improvement projects that increase the value of the home, education spending, or even investments in life milestones.

Smart Uses of Refinanced Home Equity Funds

Here are effective ways to use cash from a home equity refinance:

- Home Improvements with High ROI: Kitchen remodels, bathroom updates, or energy-efficient upgrades can add substantial property value.

- Educational Expenses: Using home equity funds to finance education can be more cost-effective than high-interest private loans.

- Major Life Events or Emergency Expenses: Refinanced funds can also provide a financial cushion during challenging times, such as covering medical bills.

Maximizing Property Value Through Improvements

When allocating funds for home improvements, consider:

- Projects with High ROI: Focus on projects that typically offer the highest return, such as kitchen upgrades, bathroom remodels, and energy-efficient installations.

- Market Trends: Consider current real estate trends in your area to choose improvements that appeal to future buyers.

- Detailed Project Planning: A well-planned project, including a clear timeline, budget, and contingency fund, can prevent unexpected costs and delays.

Investment Considerations

If using cash from home equity for investments, evaluate:

- Cost-Benefit Ratio: Consider the long-term return on investment versus the cost of borrowing.

- Tax Implications: Review any potential tax benefits or obligations related to using home equity for investment purposes.

- Future Market Conditions: Stay aware of potential market changes that could affect your home’s value and your loan’s interest rate.

Frequently Asked Questions (FAQs)

Is there a downside to refinancing my home equity loan or HELOC?

Refinancing your home equity loan or HELOC has benefits, but there are downsides to consider. It often comes with closing costs and fees, may extend your loan term, and can be time-consuming due to paperwork and processing. While it can improve cash flow, make sure it aligns with your long-term financial goals so that the benefits truly outweigh the costs.

How soon after I get a home equity loan or HELOC can I refinance?

Most lenders require a waiting period of 6 to 12 months before allowing refinancing. However, this varies by lender and your financial situation. Check with multiple lenders to compare the best home equity loan rates and terms.

Will refinancing impact my credit score?

Refinancing may temporarily lower your credit score due to a hard inquiry, but this effect is usually small and short-lived. Making on-time payments, keeping low credit utilization, and maintaining good standing on other accounts can help your score bounce back quickly.